Customer Experience is about more than just Claims

Customer Experience Helping to Drive the Insurance Value Chain

What are Brokers and Clients telling us? The most common feedback we get from Brokers and Clients is around the best way to manage claims to create a sustainable balance between great customer experience and maintaining value throughout the insurance chain.

Here’s what our Broker partners are saying they need from best in class claims management:

- Customer centricity – keeping the clients at the heart of our decision making

- Keep it simple and responsive – make the process as easy as possible, and respond as quickly as is reasonable

- Allow for the grey – life isn’t always black and white, don’t treat our clients’ claims that way

- Protect premiums - Manage claims commercially to minimise the impact on premiums

AHI addresses these critical elements for success

We’ve built our award-winning claims team around our core values:

- Customer-driven: We value our customers and managing their risk is at the heart of everything we do

- Caring: We genuinely care about our customers, staff, and the community

- Responsive: We empower our people to achieve positive outcomes in the quickest possible time

- Inspired: We make every moment count

Customer centricity

Our claims and underwriting teams are empowered to make quick decisions when it matters most, because we recognise that what we do matters. We’re not just crunching numbers, we’re caring for the wellbeing and livelihood of our customers.

The easiest way for me to show the compassion of our team is to share a story of one of our claimants who became critical ill overseas. Our team looked after not just the insured, but his family as well.

The claimant became ill whilst onboard his international flight, his condition was so serious on arrival that he was met on the tarmac by ambulance services and transported to the nearest centre of medical excellence for his condition. When it became clear he would not make a full recovery, we arranged to have him moved to the best available palliative care facility in the area. With the understanding that he would not make it home, our claims team covered the cost of, and arranged for his family to travel internationally to say goodbye to their father before he passed.

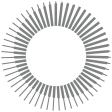

Simple and Responsive

We work in a tripartite relationship with our brokers and joint clients, so we understand that sometimes all parties need to be kept informed. We work hard with our broker network to ensure you remain abreast of major claims and their impact on both clients and premiums.

We have service level agreements in place both internally and with our best-in-class partners to ensure that claimants are supported when they need us most. As our values dictate, we empower our people and partners to make decisions in the quickest possible time so insureds receive the right care, in a timely manner to achieve positive outcomes.

Human Touch

We understand that life is not always black and white, and this can be particularly true when it comes to the grey areas of a claim. At AHI we aim to incorporate the human touch from policy design through to claims, including the guidance we provide brokers and our joint clients when it comes to understanding their specific cover needs, minimising the chance of nasty surprises at claim time.

It is one thing for us to tell you this, however, the senior broker involved in the claim story mentioned previously said...

Protect Premiums and Covered Services for Expatriates

Our 25+ years of experience specialising in the accident and health category means that we have the expertise to ensure the best cover while protecting premiums (for everyone) and ongoing benefits (for expats) through responsible claims management.

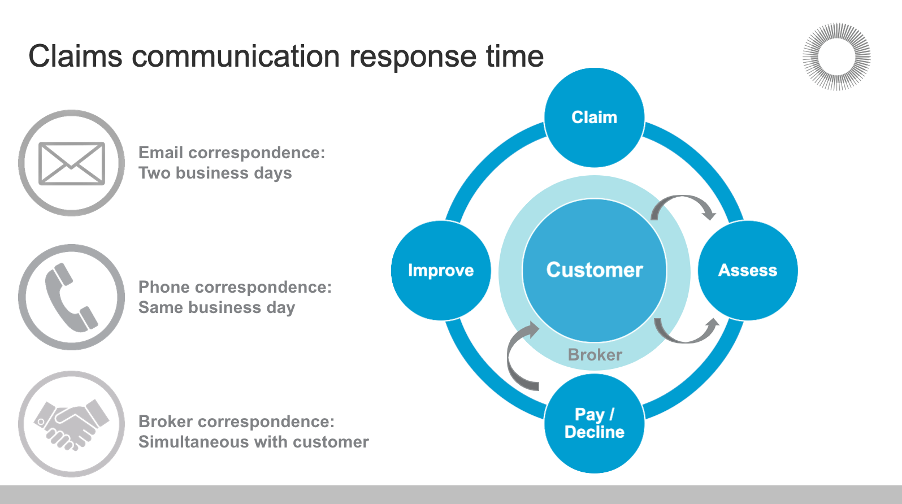

Our Head of Claims explains the claims management process our team utilise when looking at sustainable claims management, and the role of cost containment in the process. Highlighting some of the key points below.

Navigating the complex paperwork, billing and administration processes in foreign countries can be a daunting task that at times can cause more stress than the actual sickness. There is no country that epitomises the “complexity” and “craftsmanship” of medical administration better than the USA. In the USA, the resources devoted to medical administration almost match that which are devoted to providing actual treatment.

AHI Assist leverages the local expertise of our Medical Management Partners to co-ordinate:

- Claims administration

- Payment processing

- Bill editing, bill review and “cost containment” services

- Pre-admission, admission and post admission services

- Large or catastrophic case administration

- Assistance in finding a medical service or treatment provider within a local area

Critical for our clients, whether they’re corporate travel or expatriates is the “cost containment” – now before you roll your eyes, it’s not all about keeping costs low so insurers make a profit - “Cost Containment” is a standard billing review process followed by health insurance companies within the USA. It is the process of reviewing and repricing all medical-related procedures, investigations, and services etc that are charged by hospital groups.

Cost containment is not something any AHI insured clients need to be involved in. It does not prejudice rights to receive treatment. It is something that automatically occurs “in the background” between the service providers and health insurance companies.

So how does cost containment help with premiums and access to ongoing benefits?

If we continue with the USA example, cost containment is a standard and prudent measure that is part of all medical services provided within the USA.

In particular, the cost containment of Allied Health Services (Physiotherapy, Optical, Dental etc) and Pharmacy which are often subject to annual limits, helps our insured clients retain more of these benefits for use throughout the year.

Cost containment savings may be “small” for general medical consultations; however, they can be quite substantial for major hospital admissions. It is not unusual to receive savings of several hundred thousand dollars against a million-dollar hospital bill. You can imagine how important this is when it comes to calculating premiums for future years.

AHI’s decades of experience means our joint clients get the care they need, when they need it, and can focus on their recovery while we work behind the scenes to maintain sustainable claims management and underwriting that continues to create value throughout the entire insurance chain.

If you would like more information on our Corporate Travel, Inpatriate or Expatriate Covers, reach out to your dedicated underwriter or contact us today.