Agile Cover for a Disrupted and Changing Workforce

Group Personal Accident and Sickness

For the last five to ten years there has been a global conversation about technology disrupting industries. Industries have been slowly evolving towards this future of work through digital transformation, creating an agile workforce, corporate focus on wellness and fostering high performing workforces, including creating resilient employees by transitioning organisations to psychologically safe environments.

Enter worldwide pandemic – suddenly global and local businesses had weeks, not years or months to adapt, the future of work had arrived, whether we were ready or not.What has this meant for the Insurance Industry?

According to EML’s Australian Personal Injury Industry Update 2020 Review & Future Trends Report, a little more than half of respondents said their COVID19 response plan included transitioning to a remote workforce.

Beyond the technology disruption, there are numerous environmental aspects of the employment market and how work is performed that are driving change in coverage and claims management:

- Growing societal recognition and destigmatising mental health

- Compensation schemes redefining eligibility and benefits

- Contemporary approaches: focus on the person, not the condition

Equally significant in EML’s report are the economic influencers, with key industries such as construction and mining continuing to operate; and most Enterprise Bargain Agreement driven Group Personal Accident (GPA) programs remain stable. However, forecasted wage reductions will lower GPA premium collection.

The report further outlines that impacted industries are looking at ways to cut costs and are reviewing coverage via elective GPA policies, limiting or restricting benefits and reducing coverage to limit premium payable.

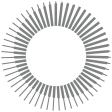

Insurers and Governments are looking to ensure that the accessibility of protection is aligned to this evolving socio-economic environment and the new nature of work. In other words, protection needs to become more agile, with a snapshot of some of the themes and trends in the graphic below.

Source: EML - Australian Personal Injury Industry Update 2020 Review & Future Trends Report

Some insurers and brokers are finding clients have started to under-insure or self-insure a portion of their people risk insurance due to hardening markets. Clients are also finding insurance products with additional exclusions for renewal and new business policies, restricting entitlement under a sickness benefit for COVID19 and extending the waiting period to 21 days.

Despite hardening markets in other insurance lines, AHI’s Accident and Health products remain market leading with new wordings coming out that maintain no mental health exclusions and ensure compliance with new regulations around unfair contract terms.

More than just Policy changes are needed…

EML’s report discusses the importance of claims management and how “interoperability between disparate systems, digitisation and automation of manual processes yields efficiency gains and higher quality case management by freeing up case managers to focus on meaningful decision making. In 2019, survey respondents foresaw the growing relevance of advanced platforms, identifying claims processing and workflow automation tools among technologies likely to significantly impact the industry in the next three to five years.”

The premise behind this is one of the core values that we share with our claims management partner. AHI’s award-winning claims team are empowered to make the decisions that ensure our customers get the best possible support and outcomes in the quickest possible timeframe – because every moment counts. We’re not just crunching numbers, we’re caring for the wellbeing and livelihood of our customers.

With insurers dropping categories and tightening policy coverage it reminds us of another article, where we discusses some of the most common feedback we get from Brokers and Clients. That is, Broker’s rely on the experience of AHI’s 25+ years to find the best way to manage claims to create a sustainable balance between great customer experience and maintaining value throughout the insurance chain. Including customer-centricity, keeping things simple and being responsive, understanding the need for case-by-case agility when it comes to policy wording interpretation and, protecting premiums.

The importance of creating value throughout the insurance chain through improved claims experience is difficult to debate as premium pressure continues to increase post-pandemic. EML’s report sites concern from “The Financial Services Council (FSC) about the sustainability of the insurance industry being "on a knife edge", with the rise of mental health claims as "a major contributing factor”.”

With the Report further detailing the increase in mental health conditions and the fact that the cost of these claims is typically approximately 2.5 times the cost of other claims, and involve 2.5 times more time off work.

The depth of the increase is outlined in a study by KPMG and the Financial Services Council released in June [that] found the number of mental health claims had doubled over the past five years, with mental disorders now the third most common cause of disability income claims, ahead of cancer and behind accidents.

What can Insurers and Brokers do to Mitigate Client Concerns?

Our Underwriters work closely with our Brokers to ensure our joint clients have the appropriate cover so there are no nasty surprises at claim time, while ensuring the premium is sustainable for everyone.

When it comes to claim time, our claims team keep the customer at the heart of everything we do - from the first call and managing their immediate care, through to working closely with Brokers and partners to deliver a united customer experience that sees them achieve the best possible outcome in the shortest timeframe.

Click here for more information on our Group Personal Accident and Sickness Cover or contact one of our dedicated underwriters for assistance.