Brokers Guide to Personal Accident & Sickness Insurance

The what and why. Plus key reasons your clients need it.

What is Personal Accident and Sickness insurance?

Individual Personal Accident and Sickness insurance is designed to cover Individual business owners, sole contractors and those looking for cover outside working hours. It covers these individuals in the event of financial loss should they be involved in an accident, suffer an illness or disability, or look after their families in case of accidental death.

Group Personal Accident and Sickness insurance is tailored for companies, industry associations, membership organisations and organisations with Enterprise Bargaining Agreements to help cover the financial loss associated with accident and sickness or accidental death of employees.

Why it’s an important part of a Broker’s product offering

There is an extensive range of insurance products on the market, and knowing which ones are critical for your clients and deserve your recommendation can sometimes feel like navigating a mine field.

As Richard Branson once said, “Look after your staff, and they’ll look after your customers”. Knowing their employer has them covered should anything go wrong is key to staff feeling confident and secure, no matter where they are on the world.

For those businesses that have international operations, the obvious considerations are corporate travel, expatriate and kidnap and ransom insurance. But for all organisations, employee loss and business loss of income should never be missed.

The accident and health category can be a smaller ticket item for some businesses, and mistakenly overlooked. For sole traders, Individual Personal Accident covers the breadwinner and extends to provide benefits for their families. Larger organisations however, have long understood the significant losses that can occur without this critical cover. The irony here is that the impact on small to medium businesses can be catastrophic, as business continuity could be considered much shallower, with smaller staff numbers and less ability to hire key resources cover. Therefore the loss of one key employee could potentially cripple the business, resulting in critical loss of income or closure. Not to mention the knock-on effect to their families and personal lives.

For broker’s analysing their customer’s portfolio, adding a personal accident option is easy. With AHI’s online broker portal you can quote and bind an Individual Personal Accident policy within minutes. For Group Personal accident insurance, you have the comfort of speaking with one of our specialist underwriters who can ensure you get the best advice and cover for your customers, so they know they’re protecting what matters most to them. And you have confidence that we’ve got them and you covered with over 25 years’ experience.

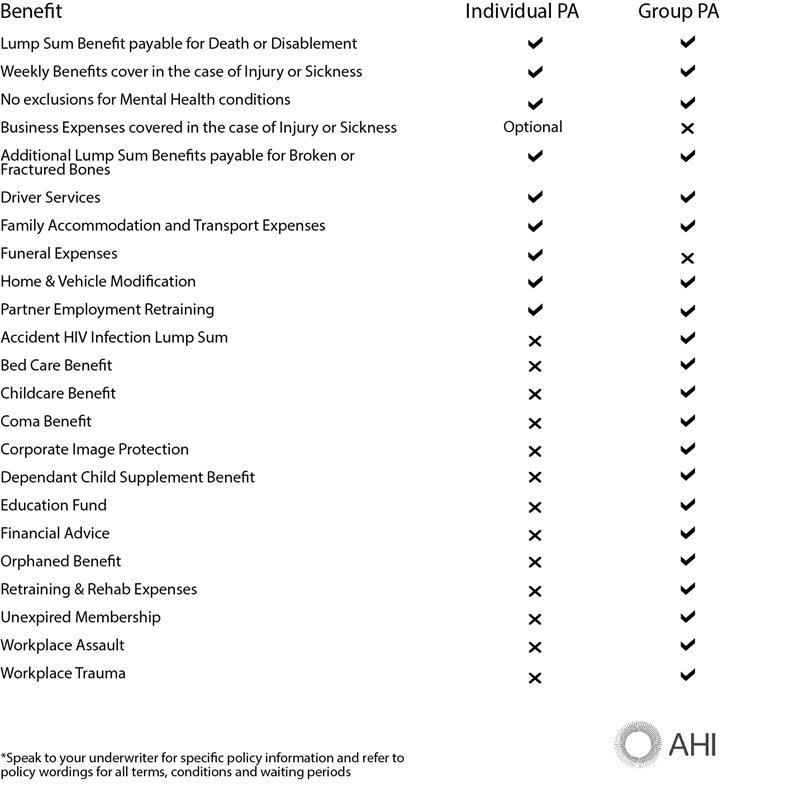

Core elements of Personal Accident and Sickness Insurance

On the surface, it’s easy to think there is little difference between policies, but where the difference lies is knowing you have a team of specialists that are driven to put you and your customer at the heart of every stage of the journey, whether that’s the fairness and compassion we show during a claim, or how we support you and the customer through the experience.

If you’re ticking boxes for must haves in a Personal Accident policy, below is a solid guideline to get you started:

Key reasons to help your customer understand the importance of good cover

- Business continuity

- Protect their health and wellbeing and that of their families and employees

- Protect their livelihood

- Regulatory requirements

If you’d like to learn more, feel free to contact your local Underwriter for more information or advice on the best cover for your customers.